Things about Car Insurance

Wiki Article

The Definitive Guide to Cheap Car Insurance

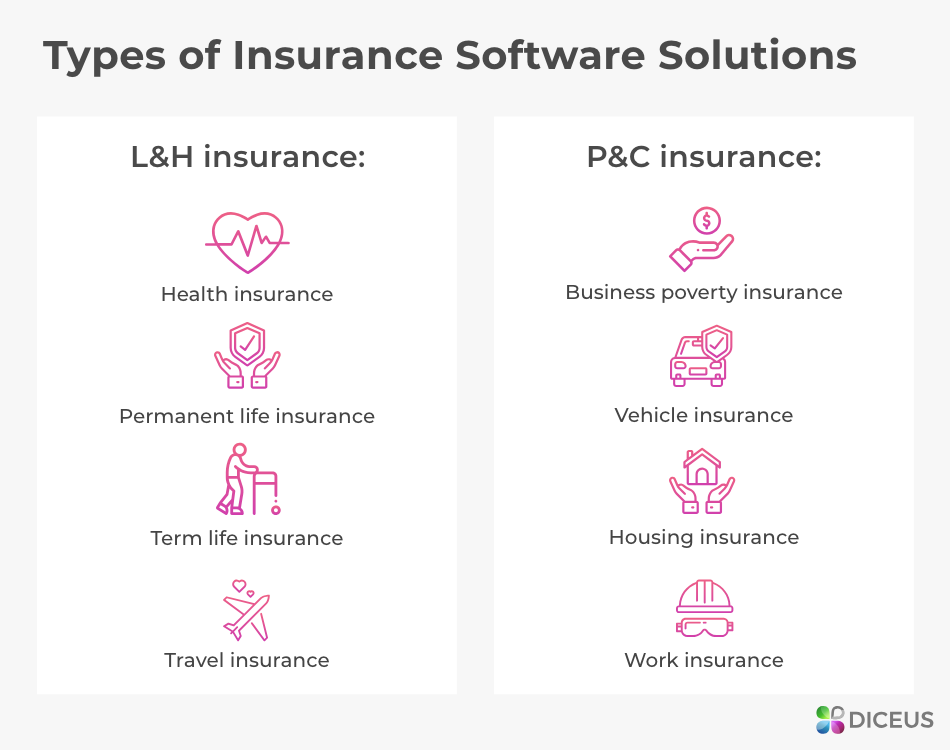

Table of ContentsSome Known Incorrect Statements About Life Insurance 3 Simple Techniques For Life InsuranceThe Greatest Guide To Travel InsuranceThe 10-Second Trick For Insurance

You Might Want Disability Insurance Policy Too "As opposed to what lots of people assume, their home or car is not their greatest property. Instead, it is their capacity to earn an income. Lots of specialists do not insure the possibility of an impairment," said John Barnes, CFP and also owner of My Family Life Insurance Coverage, in an e-mail to The Equilibrium.

The info listed below concentrates on life insurance policy marketed to people. Term Term Insurance is the easiest kind of life insurance policy. It pays only if fatality takes place throughout the regard to the plan, which is generally from one to thirty years. A lot of term policies have nothing else benefit arrangements. There are 2 fundamental sorts of term life insurance policy policies: degree term as well as reducing term.

The expense per $1,000 of benefit rises as the guaranteed person ages, and also it obviously gets extremely high when the guaranteed lives to 80 as well as past. The insurance provider could charge a costs that increases yearly, however that would make it really hard for the majority of people to manage life insurance policy at advanced ages.

The 5-Minute Rule for Cheap Car Insurance

Insurance plan are made on the concept that although we can not quit unfortunate occasions occurring, we can protect ourselves monetarily versus them. There are a substantial number of various insurance plans available on the market, and also all insurers attempt to convince us of the advantages of their particular product. A lot so that it can be hard to make a decision which insurance policies are really needed, as well as which ones we can realistically live without.Researchers have actually found that if the primary wage income earner were to die their family members would just have the ability to cover their household expenditures for simply a couple of months; one in four family members would have problems covering their outgoings instantly. A lot of insurance providers advise that you secure cover for around 10 times your yearly earnings - health insurance.

You need to additionally consider child care costs, as well as future college charges if applicable. There are two major sorts of life insurance coverage plan to pick from: entire life policies, and also term life plans. You spend for entire life plans until you pass away, and also you spend for term life policies for a set time period figured out when you take out the policy.

Medical Insurance, Health And Wellness insurance is another one of the 4 primary kinds of insurance coverage that professionals suggest. A current research study exposed that sixty two percent of individual bankruptcies in the United States in 2007 were as a direct result of health issue. A shocking seventy 8 percent of these filers had medical insurance when their masshealth disease began.

All about Car Insurance

Premiums differ considerably according to your age, your existing state of health and wellness, and your lifestyle. Car Insurance, Rule range various countries, however the relevance of car insurance stays constant. Also if it is not a legal demand to take out car insurance policy where you live it is extremely advised that you have some sort of policy in position as you will still need to assume monetary duty in the like this case of a mishap.Additionally, your car is usually one of your most valuable possessions, as well as if it is harmed in a mishap you may have a hard time to spend for fixings, or for a replacement. You can also locate on your own accountable for injuries received by your guests, or the driver of one more car, as well go to these guys as for damage caused to another vehicle as a result of your negligence.

General insurance covers home, your traveling, vehicle, and also wellness (non-life properties) from fire, floodings, crashes, synthetic calamities, and also burglary. Various kinds of general insurance policy consist of motor insurance coverage, medical insurance, travel insurance coverage, as well as house insurance. A general insurance coverage spends for the losses that are incurred by the insured during the duration of the plan.

Continue reading to recognize more regarding them: As the house is an important belongings, it is important to safeguard your house with a proper. Residence as well as home insurance secure your house and also the products in it. A residence insurance plan basically covers man-made as well as natural conditions that may result in damages or loss.

6 Easy Facts About Health Insurance Described

It is available in 2 types, third-party as well as extensive. When your vehicle is responsible for a mishap, third-party insurance policy deals with the injury caused to a third-party. Nevertheless, you should take right into account one truth that it does not cover any of your lorry's damages. It is also vital to note that third-party electric motor insurance coverage is compulsory as per the Electric Motor Automobiles Act, 1988.

A hospitalization expenses approximately the sum guaranteed. When it comes to medical insurance, one can go with a standalone health policy or a family members floater plan that supplies coverage for all family participants. Life insurance supplies insurance coverage for your life. If a situation happens in which the insurance holder has a sudden death within the term of the policy, after that the candidate obtains the sum assured by the insurer.

Life insurance policy is various from general insurance policy on different specifications: is a temporary agreement whereas life insurance policy is a lasting agreement. In the instance of life insurance policy, the advantages and also the amount guaranteed is paid on the maturation of the policy or in the event of the policy holder's death.

They are however not compulsory to have. The basic insurance policy cover that is compulsory is third-party responsibility auto insurance policy. This is the minimal protection that an automobile must have before they can ply on Indian roadways. Every single kind of general insurance cover comes with an aim, to supply insurance coverage for a specific element.

Report this wiki page